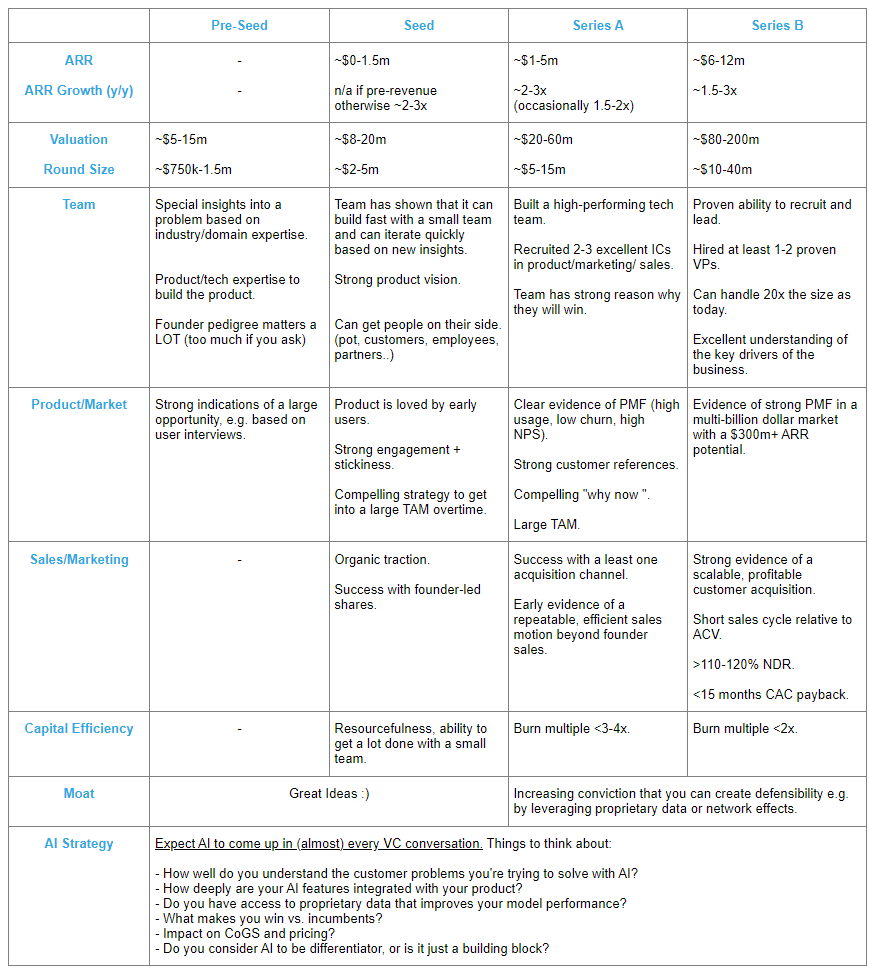

The SaaS Funding Napkin provides the essential milestones that SaaS founders should to achieve to secure venture capital and presents them in a simple format, akin to jotting them down on a napkin. This resource serves as valuable reference material for any SaaS founder.

At the 2023 SaaS conference in San Mateo, Christoph Janz of Point Nine Ventures provided a preview of the updated version of his renowned resource, the SaaS Funding Napkin. This document, commonly referred to as the “SaaS Napkin,” compiles essential SaaS milestones crucial for securing venture capital.

Presented in a concise and accessible format, akin to information scribbled on the back of a napkin, it serves as a valuable reference for early-stage SaaS founders seeking to navigate the path to building a successful, VC-backed business.

2023 SaaS Funding Napkin

Key Takeaways from the 2023 SaaS Napkin

1. Focus on Capital Efficiency:

✓ In 2023, there is a significant emphasis on capital efficiency compared to previous years.

✓ Investors now prioritize healthy and sustainable growth over rapid expansion at any cost.

✓ Finding the right balance between growth and capital efficiency is crucial.

✓ Metrics such as burn multiple, CAC efficiency, and sustainable growth are paramount.

2. Burn Multiple as a Key Metric:

✓ The burn multiple, indicating how much capital is needed to add a dollar of net new Annual Recurring Revenue (ARR), is a crucial metric.

✓ A lower burn multiple is desirable, especially for companies with up to $25M ARR.

✓ In situations with a short runway and a high burn multiple, companies should focus on cost-saving strategies.

✓ Cost per Acquistion (CAC) payback period is an important metric to consider when evaluating marketing and sales spend.

3. Valuation Realities:

✓ Valuations have been impacted by market fluctuations, with a notable decline in pre-IPO investor willingness to pay.

✓ Series A is less affected, but overall, investors are reconsidering the high valuations seen in previous years.

4. Importance of AI Strategy:

✓ Investors now inquire about a convincing AI strategy, even for non-AI native startups.

✓ Emphasises the need for deep integration of AI into products and a clear plan to compete with established players and large foundational models.

✓ Bigger SaaS companies are quick to embrace AI, and startups need a unique edge against them; particularly focus on making the product more valuable and defensible in the long run.

✓ Considerations include the depth of AI integration, competition against major players, and the ability to solve customer problems more effectively with AI.

Feel free to watch the original presentation by Christoph Janz here.

To gain a comprehensive understanding of and effectively manage these dynamics, it’s crucial to employ specialised SaaS metrics. If you are looking to upgrade the financial insights with your SaaS business, don’t hesitate to contact the SaaS accountants at Fullstack.

Was this article helpful?

Related Posts

- Growing a SaaS Company: The 3 Drivers

Managing a software as a service (SaaS) business so that it is successful has more…

- SAAS metrics: Five Measures That Really Matter

When you're a SaaS business, metrics really matter. Due to their unique operating and revenue…

- SaaS Revenue Recognition

For SaaS companies it is easy to get an uneven idea of financial position because…

- Startup Funding

Getting your startup funding is an essential skill for most tech startup founding teams. However…

- Navigating DeFi in 2023/2024

The ATO has recently released their guidance on Decentralised Finance and wrapping crypto. Illustrating the…

- Unveiling the Key Figures of Discretionary Trusts: Meet the Influential Players

In the intricate landscape of wealth management and asset protection, discretionary trusts are potent vehicles…

- SaaS Revenue Recognition

For SaaS companies it is easy to get an uneven idea of financial position because…